On 29 June 2023, the Court of Justice of the European Union ruled in the Cabot Plastics Belgium case. This case concerns the concept of the ‘fixed establishment’ for VAT purposes. In short, the Court held that the human and technical resources of a Belgian toll manufacturer do not constitute a fixed establishment of a client (the principal) established outside the EU. This was ruled despite the facts that the parties were affiliated entities and that there was an exclusive contractual undertaking between the principal and the toll manufacturer.

In this article, we look at the European court ruling and discuss the possible implications for your business.

Background of the fixed establishment (VAT)

The fixed establishment (FE) acts as the starting point for the levy of VAT. The existence of an FE determines, among other things, whether VAT is chargeable and the place where supplies are subject to VAT. An FE for VAT purposes exists ‘automatically’ if the conditions are met. Therefore, it is not optional, and no request or application is required. If there is an FE for VAT purposes, this can affect, among other things, the chargeability of VAT, administrative obligations and VAT registrations. To meet your VAT obligations, it is therefore crucial for you to know whether an FE is present.

The concept of permanent establishment has been defined since 2011 in the European Union (EU) VAT Regulation. It must concern an establishment characterised by a sufficient degree of permanence and, in terms of personnel and technical resources, an appropriate structure for supplying or receiving services. In practice, the interpretation of the term regularly leads to disputes with (foreign) tax authorities. You can read a more detailed explanation of the development of the term here.

Facts in the Cabot Plastics case

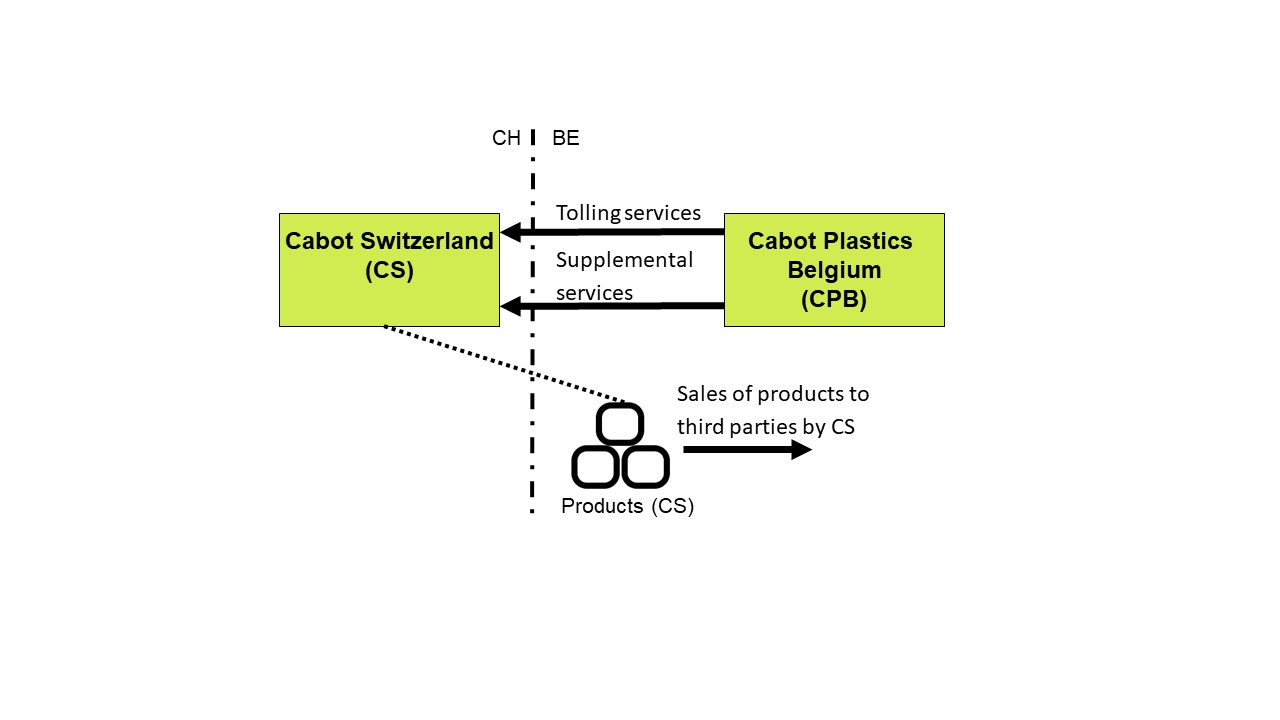

Before discussing the judgement and its practical relevance in more detail, we will first outline the facts of the case. Cabot Plastics Belgium (CPB) is a toll manufacturer established in Belgium. CPB produces goods (plastics) that are and remain owned by the affiliated entity Cabot Switzerland (CS) which is established in Switzerland. After the goods are manufactured, CS sells them to its clients. In addition to toll manufacturing services, CPB also provides additional services to CS, including logistical assistance and sales support activities. Contractually, CPB is obligated to use its assets exclusively for CS’s activities. Briefly stated, the referring Belgian court wants to know whether CPB’s personnel and technical resources in Belgium constitute an FE for VAT purposes for CS. This can be represented schematically as follows:

Court of Justice ruling: no fixed establishment in VAT

With its judgement, the Court of Justice indicates in short that the human and technical resources of the Belgian toll manufacturer in the case at hand do not constitute a fixed establishment of the Swiss principal, despite the fact that the principal and the toll manufacturer are affiliated parties. The fact that there is an exclusive contractual undertaking, and the human and technical resources of the Belgian toll manufacturer are solely used for these services, does not alter this conclusion. The Belgian toll manufacturer can still dispose of the resources for its own needs.

This judgement is based on the facts of this specific case. Therefore, it cannot be precluded that an FE may be present in similar cases with slightly different circumstances. For example, if the principle has immediate and permanent access to the resources as if they were its own resources.

Practical relevance for businesses

The concept of the FE for VAT purposes has been under discussion for some time. This was prompted by a remarkable 2020 judgement by the Court of Justice, the so-called Dong Yang case. In this case, the Court ruled, in short, that a subsidiary can constitute an FE of its parent company. Subsequently, in the Berlin Chemie case, the Court indicated that the human and technical resources of a group company can only constitute an FE of another entrepreneur within the group if that other entrepreneur can dispose of the resources as if they were its own. In practice, the complex and rather abstract wording of the European courts has led to a great deal of uncertainty regarding the precise criteria for the existence of an FE for VAT purposes. Increasingly, tax authorities of different EU member states are taking the view that a group company’s resources constitute the FE of another entity within the group.

With its judgment in the Cabot Plastics case, the Court of Justice now rules that there is no FE if the recipient of the supplies does not have an appropriate structure, in terms of human and technical resources, that could form a fixed establishment in the member state of supply of services. This is ruled despite the exclusive contractual undertaking and the affiliation between the parties. This conclusion is in line with the Berlin Chemie case.

At the same time, the Court of Justice of the EU emphasises that situations may still occur in which the principal, despite the absence of own human and technical resources, can dispose of these resources as if they were his own resources. In such a case, an FE may still arise.

Be alert for the FE

The existence of an FE can have a major impact on your VAT position. It is therefore important to monitor on an ongoing basis whether an FE exists. Does your company deploy human or technical resources abroad? If so, be sure to check for your company whether the deployment and level of disposal of personnel and technical resources in other countries results in an FE for VAT purposes. Our advisors can, of course, help you with this.

If you have any questions about your VAT position or want advice on your foreign operations, Marisa Hut, Barthold Bergman and Stevie Mols of the team VAT & Customs Advisory would be happy to discuss these matters with you.

The legislation and regulations in this area may be subject to change. We recommend that you discuss the potential impact of this with your Baker Tilly consultant.