On 14 June 2019, the Dutch State Secretary of Finance answered questions from members of the Dutch parliament about the impact in the Netherlands of the EU case law of 26 February 2019. The State Secretary announced an amendment with regard to the ‘substance’ requirements for intermediate holding companies in connection with the exemption for Dutch dividend withholding tax (DWT).

Important judgment Court of Justice of European Union

The Court of Justice of the European Union (CJEU) issued an important judgment on 26 February 2019. The CJEU ruled that an EU member state is obliged to deny the benefits of the EU Parent-subsidiary Directive in the event of abuse of rights. In the same judgment, the CJEU has provided guidance on how to determine whether there is indeed abuse of rights.

Amendment of the DWT Act

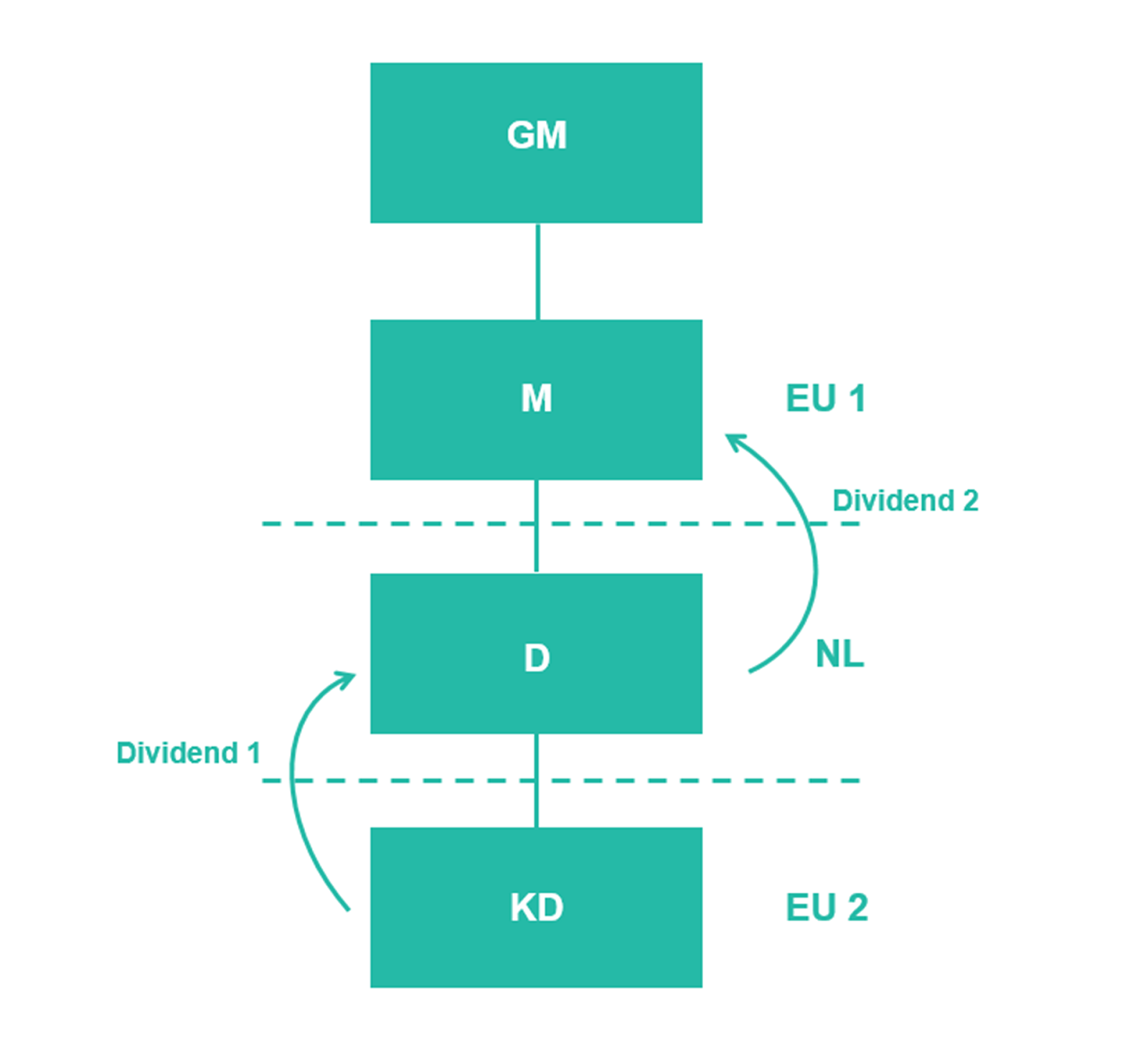

In figure 1 M (established in an EU Member State) and D (established in the Netherlands) are intermediate holding companies. Currently, M can apply for an exemption of DWT (for dividend 2) if M satisfies certain substance requirements. As of 1 January 2020, the Dutch Tax Authorities (DTA) will have the possibility to deny the withholding exemption even if M complies with the substance requirements (introduction of a counterproof measure). In such a case, the DTA have to prove that there is abuse of rights.

Impact on tax treaties

Following the judgment of the CJEU, EU member states are obliged to deny the benefits of the EU Parent-subsidiary Directive in cases of abuse of rights. According to the State Secretary, the judgment of the CJEU does not mean that the benefits of tax treaties also have to be denied in cases of abuse of rights. Currently, tax treaty benefits can only be denied if the treaty itself contains an anti-abuse measure (which for most treaties is not the case). However, the multilateral instrument will enter into force on 1 January 2020. As a result, tax treaties concluded by the Netherlands will contain an anti-abuse measure, denying treaty benefits in cases of abuse of rights.

Impact on Dutch participation exemption

Currently, Dutch tax law provides for an exemption for the dividend received by D (dividend 1), regardless of the substance that D has. One of the questions raised was whether the judgment of the CJEU would also have an impact on the Dutch participation exemption in cases of abuse of rights. The State Secretary indicated that the judgment of the CJEU does not provide a direct answer to that question. He will take it into account in further research into the participation exemption.

Consequences

The anti-abuse measure in the DWT legislation will be adjusted (slightly) as a result of the judgment of the CJEU of 26 February 2019. As of 1 January 2020, a counterproof measure will be introduced under which the DTA can deny the DWT exemption in cases of abuse of rights, even if the substance requirements are satisfied. In the opinion of the State Secretary, the judgment of the CJEU does not have an impact on the application of tax treaties.

More information

We will keep you informed about further developments on this subject. Do you have questions about the consequences? Please contact your tax adviser at Baker Tilly.

This news release, published on 21 June 2019, contains general information. No rights can be derived from its contents.

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.

Other insights

-

Minimum taxation Pillar 2: exclusions, safe harbours, and pitfalls

-

Pillar Two: How to prepare for the new minimum taxation

-

Pillar Two: Introducing a minimum level of taxation for multinational enterprises and large companies in 2024