Within the framework of the ‘EU Green Deal’, the European Union is working hard to achieve the set climate ambitions. One of the concrete objectives is to reduce greenhouse gas emissions by at least 55% compared to 1990 levels between now and 2030. To achieve this, the European Council recently decided to introduce a new EU border levy: the ‘Carbon Border Adjustment Mechanism’ (hereinafter: CBAM). In this article, we discuss the main features of this levy and we discuss the importance for practice.

Background: the Emission Trading System

Although the climate ambitions were still quite modest at the time, the EU introduced the Emission Trading System (hereinafter: the ETS) in 2005. At its core, this system consists of a centralised market for trade in emission certificates that energy-intensive companies in the oil and steel industry, among others, must purchase to compensate their emissions. The idea was that this cost item would encourage companies to invest in green technology.

The introduction of the CBAM is related to the fear that market participants have partially circumvented the application of the ETS. As the price of ETS emission certificates has risen sharply over the years (from around 80 euro cents per certificate in 2008 to around 85 euro in 2022), according to the EU regulator there is a trend where polluting industries move their production to countries outside the EU where the ETS does not apply. The CBAM tries to counteract this so-called ‘carbon leakage’.

Functioning of the CBAM

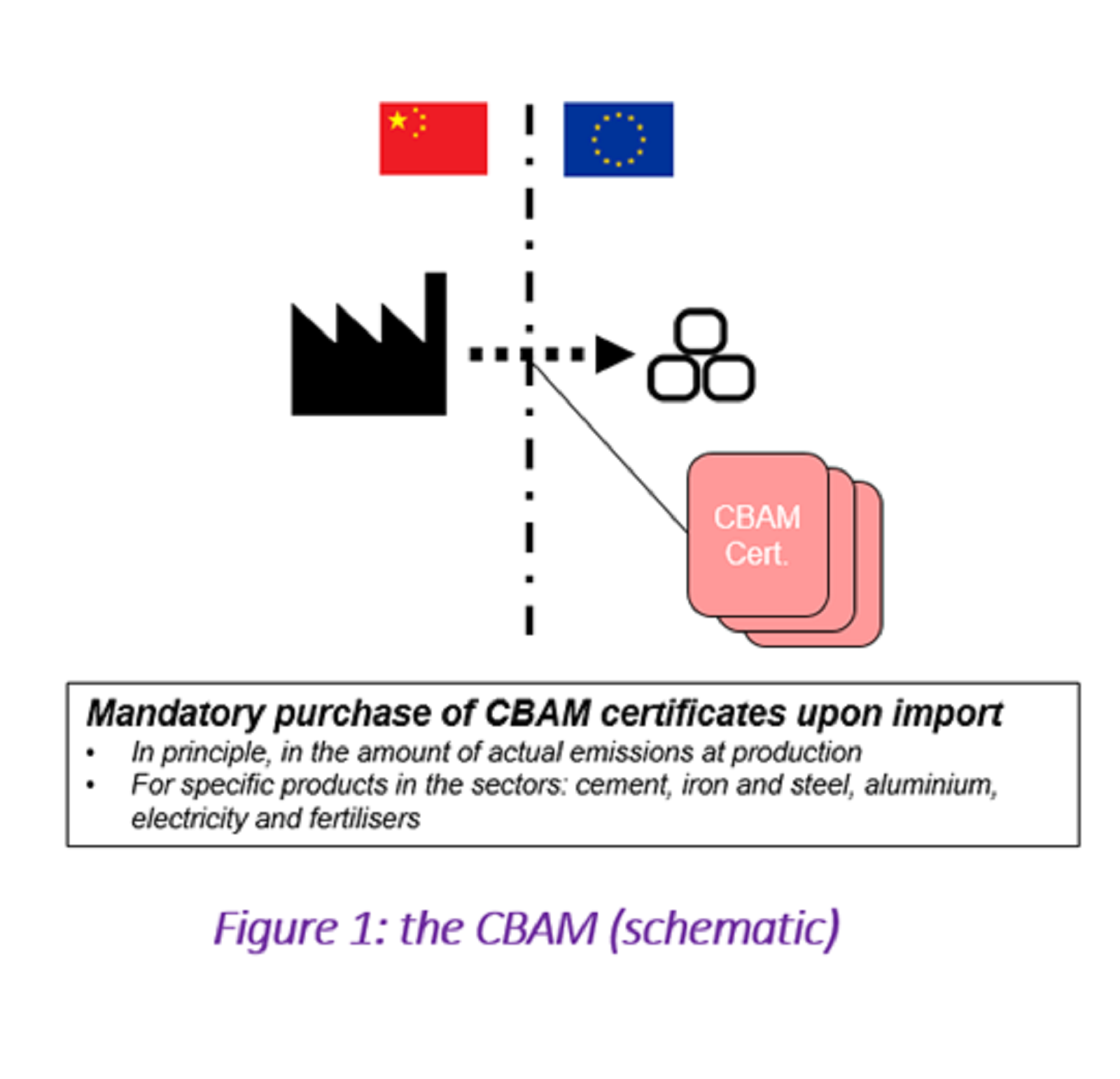

The CBAM is committed to apply an EU border levy on imports of goods from non-EU countries whose production in the EU would otherwise be subject to the ETS. Similar to the ETS, the importer (or better: the CBAM declarant) will be required to purchase emission certificates corresponding to emissions released during production outside the EU when importing for example, cement, iron and steel, aluminium, electricity and fertiliser. This prevents carbon leakage. It will no longer be (more) beneficial to move heavy-emission industries to non-EU countries.

Main elements of the CBAM

Although not all the details of the CBAM have yet been elaborated, the system is broadly known. From the preliminary information, the following aspects emerge as most relevant:

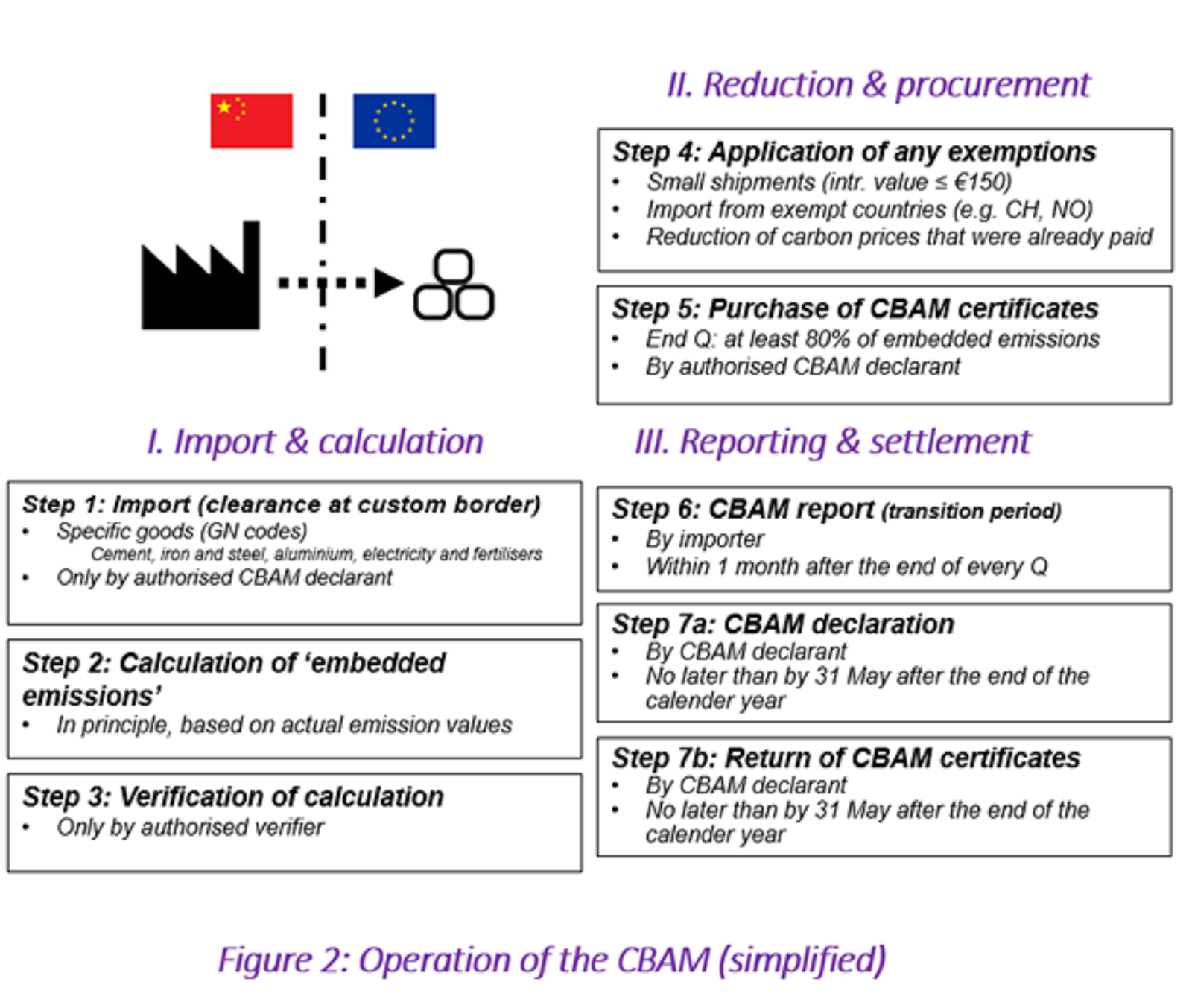

Product range: For the time being, the CBAM will only apply to specific goods in the categories steel and iron products, aluminium, electricity, fertilisers and cement. The appendices to the proposal contain an overview of these products according to their CN codes.

CBAM declarant: The levy is settled by ‘CBAM declarants’ specifically authorised for this purpose. These CBAM declarants must meet various reliability requirements and be included in a central register. They are intended to submit CBAM declarations annually and to purchase the necessary certificates. Only CBAM declarants will be allowed to import the mentioned products into the EU in the future. To be eligible for authorisation, an importer or (indirect) customs representative must be established in the EU.

Calculation of emission values: In principle, the emission values of the imported goods (embedded emissions) are calculated on the basis of the greenhouse gas emissions that actually occurred during production. If these cannot be adequately determined, or if it concerns electricity, standard values will be assumed. It is mandatory to have the calculations checked by a recognised verifier.

Purchase of certificates: CBAM declarants will be required to purchase certificates on a central platform. The number of certificates required depends on the embedded emissions of the goods cleared by the CBAM declarants. The price of the certificates shall correspond to the weekly average of the price of ETS certificates. CBAM declarants must have at least 80% of their required certificates in stock by the end of each quarter.

CBAM declaration: No later than by 31 May, each CBAM declarant shall have submitted a CBAM declaration for the previous calendar year. The declaration includes amongst others information on the quantity of the imported goods and the embedded emissions. CBAM declarants shall be obliged to keep careful records, in particular with regard to the calculation of embedded emissions. In addition, they must return the necessary certificates for the goods imported in the previous calendar year by 31 May.

Reductions and exemptions: Certain import flows are exempted from the CBAM. This concerns, for example, small shipments with an intrinsic value of no more than €150 and the import of products from ecologically responsible acting countries such as Norway and Switzerland. The CBAM also has the possibility to reduce the number of certificates required in the event that carbon levies have already been paid in the country of origin.

Entry into force: A limited version of the CBAM will enter into force from the fourth quarter of 2023 until the end of 2025. During this transitional period, certain (reporting) obligations apply to the importer, but no certificates need to be purchased yet. From 2026, the CBAM shall enter into force fully and without reservation.

Practical relevance

It is expected that the CBAM will have a significant impact on market participants in sectors where there is a lively trade in the identified goods (cement, steel and iron, fertilisers, electricity and aluminium). Firstly, the obligation to purchase certificates at import can lead to a significantly higher cost. For example, assuming two tonnes of CO2-emissions for (the production of) one tonne of steel with a market value of €900, the application of the CBAM results in an increase in the import price by almost 19%. The increased cost prices are expected to ultimately result in higher consumer prices.

Another consideration is whether the CBAM will cause noticeable shifts in trade and production patterns. We do not exclude producers from looking for alternatives not covered by the CBAM. It is also possible that one chooses to no longer import the semi-finished product encumbered with certificates, but instead the finished product. While the CBAM Regulation contains anti-circumvention provisions, we believe that the EU regulator is likely to expand the list of products covered by the CBAM over the years. Such extensions to the scope of application have already occurred in the ETS.

What are the consequences for your business?

Not all aspects of the CBAM have yet been fully elaborated. This means that, despite the decision of the European Council, changes or additions may still occur. It is therefore important to closely monitor the developments. Should you wish to discuss the consequences of the CBAM for your company in response to this article, please contact Marisa Hut or Stevie Mols. Baker Tilly is also happy to assist you in mapping the impact of the Green Deal and ETS on your company and how your business model can anticipate this in a timely manner through sustainability and ESG factors. From strategy to execution. If you would like to review this further, please contact Lucy Lau.

The legislation and regulations in this area may be subject to change. We recommend that you discuss the potential impact of this with your Baker Tilly consultant.