Baker Tilly has developed a web-app with which taxpayers that are liable to corporate income taxation (such as the Dutch BV) can gain insights into their ATAD2-exposures and the additional ATAD2 administration obligation, by answering a number of questions.

What is ATAD2?

Per 1 January 2020, the Dutch Corporate Income Tax Act of 1969 was amended to include complex anti-abuse measures. This is the result of an EU Directive against tax avoidance (ATAD2). ATAD is an acronym for the Anti-Tax Avoidance Directive. ATAD2 aims to combat tax avoidance due to differences between the tax systems of different countries. However, even if there is no tax avoidance, ATAD2 has consequences for Dutch taxpayers. This is because ATAD2 leads to significant administration obligations.

Web-app ATAD2

The ATAD2 web-app provides an initial insight into the exposures and the administration obligation of ATAD2, on the basis of your answers to a number of questions. If you would like to receive a digital version of the findings of the report, or if you have any further questions, please provide us with your contact details.

ATAD2 combats hybrid mismatches

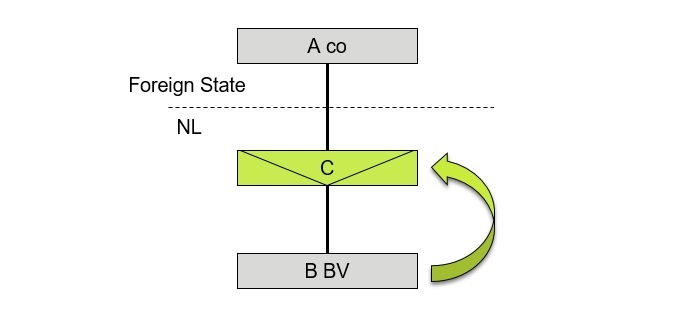

ATAD2 can be illustrated by means of the following example:

B BV is part of a multinational enterprise. B BV performs payments to C, which are in principle tax deductible. Dutch tax legislation considers C to be transparent. This means that for Dutch tax purposes it is assumed that the participants of this entity (i.e. A Co) pay taxes over the profit of C, in the Foreign State. However, this is not the case, as the tax legislation of the Foreign State deems C to be independently subject to taxation. Consequently, the Foreign State assumes that C itself pays profit taxes in the Netherlands.

This kind of differences in qualifications (mismatch due to a hybrid entity) lead to a deduction of expenses (in the Netherlands) without a corresponding inclusion in taxation (in the Netherlands or the Foreign State). Hybrid mismatches may also lead to double deduction. Both cases are considered undesirable. The EU has therefore drawn up the ATAD2 Directive, which addresses the undesired consequences of hybrid mismatches. In the example above, ATAD2 leads to the deduction at the level of B BV being denied.

Which hybrid mismatches are tackled?

Besides the mismatch due to a hybrid entity, the consequences of amongst others the following hybrid mismatches are tackled by ATAD2:

Hybrid financial instruments

One State recognises a deductible (interest) expense, the other State sees exempt (dividend) income.

Hybrid permanent establishments

One State recognises the permanent establishment, the other State does not.

Imported hybrid mismatches

The Dutch taxpayer performs a deductible payment to an associated enterprise, that passes on this payment to another associated enterprise (a related subsequent passing-on of the payment). This entity passes the payment on to another associated entity, et cetera. A hybrid mismatch occurs in one of the subsequent payments, but no correction takes place at that level. In such a case, ATAD2 stipulates that the deduction in the Netherlands must be denied.

Extensive administration obligation

The administration obligations are expanded considerably by ATAD2. The Dutch taxpayer must include and substantiate in its administration how the ATAD2 legislation applies to all remunerations and payments to associated entities. If the requisite documentation is not provided in a timely manner upon request by the Dutch tax authorities, the burden of proof can be reversed. This will (potentially) make it more difficult to demonstrate that ATAD2 does not apply.

Contact

Should you have any questions as a result of this news report, please contact us at the following email address: [email protected].

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.

Other insights

-

Minimum taxation Pillar 2: exclusions, safe harbours, and pitfalls

-

Pillar Two: How to prepare for the new minimum taxation

-

Pillar Two: Introducing a minimum level of taxation for multinational enterprises and large companies in 2024