Gas prices have been skyrocketing up to 800% during the past year. For households this means higher heating prices. However, high energy prices could also provide incentives for investments in the Dutch Heat Transition, despite the negative implications.

We analysed the Heat Transition Vision reports which municipalities had to publish before the end of 2021. With this deadline now past, we take a closer look at which business, investment and M&A opportunities may arise.

Gas prices have been skyrocketing up to 800% during the past year. For households this means higher heating prices. However, high energy prices could also provide incentives for investments in the Dutch Heat Transition, despite the negative implications.

We analysed the Heat Transition Vision reports which municipalities had to publish before the end of 2021. With this deadline now past, we take a closer look at which business, investment and M&A opportunities may arise.

The heat transition is part of a wide set of climate regulations

The Dutch Heat Transition is a keystone in the Dutch climate change policy. One of its major aims is to phase out natural gas for heating buildings and other residential uses by 2050. This was set out in the 2019 Dutch Green Deal, which aims to curb emissions by 49% in 2030 and 95% in 2050, compared to 1990 levels. At European level, this policy is embedded in the EU 2030 climate and energy framework, which is the EU’s contribution to the 2015 UN Paris agreement on climate change. The EU climate goals may be further raised, following the Fit for 55 Initiative by the European Commission and will potentially require further action in the Netherlands. As announced over the past few weeks, the new coalition agreement has pledged an investment of EUR 35 billion for climate related investments.

The heat transition offers opportunities in 3 areas

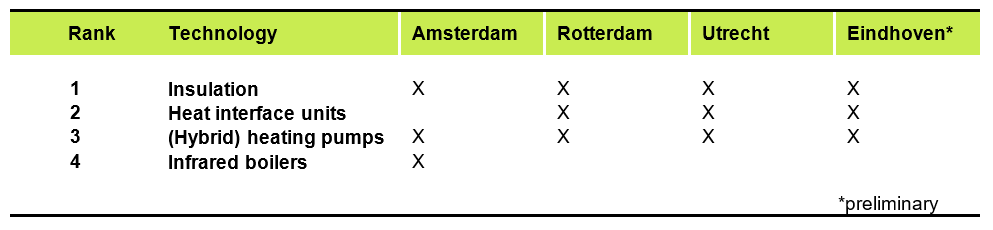

Many stakeholders are involved with the energy transition, but the municipalities have been given responsibility for changing household energy consumption levels. We have compared the Transition Vision reports published by the larger municipalities for any overlap in investment strategies. While the reports widely differ in scope and level of detail provided, we can conclude that the heat transition offers opportunities in 3 main areas:

1. Insulation

There has been emphasis on investment in, and promotion of, insulation and energy saving as ‘no-regret investments’ in all reports. For example, Utrecht is planning a 14% energy saving by insulating all buildings to energy level B. Amsterdam has the most detailed and ambitious plans and aims to realise its targets by 2040. Subsidies to incentivise energy saving investments are currently under development in various municipalities and at national level. The new coalition agreement has indicated its intention to allocate part of its EUR 35 billion fund to a national building insulation program. In our view, companies providing insulation or new efficient (heating) technologies will face increased demand as a result of the heat transition.

2. Infrastructure

Changing sources of energy will require changes to the infrastructure: heat networks have to be built in designated areas, reinforcement of the electricity grid will be necessary to accommodate demand changes. And finally, the existing gas pipeline network will need to be adjusted for the switch to green gas. Construction companies and network providers alike will face increased demand to supply the heat infrastructure of the future. New technology which is compatible with the new heat sources needs to be installed at household level. This is a large-scale opportunity for providers of (sustainable) heating technology.

3. Switch to Sustainable energy sources

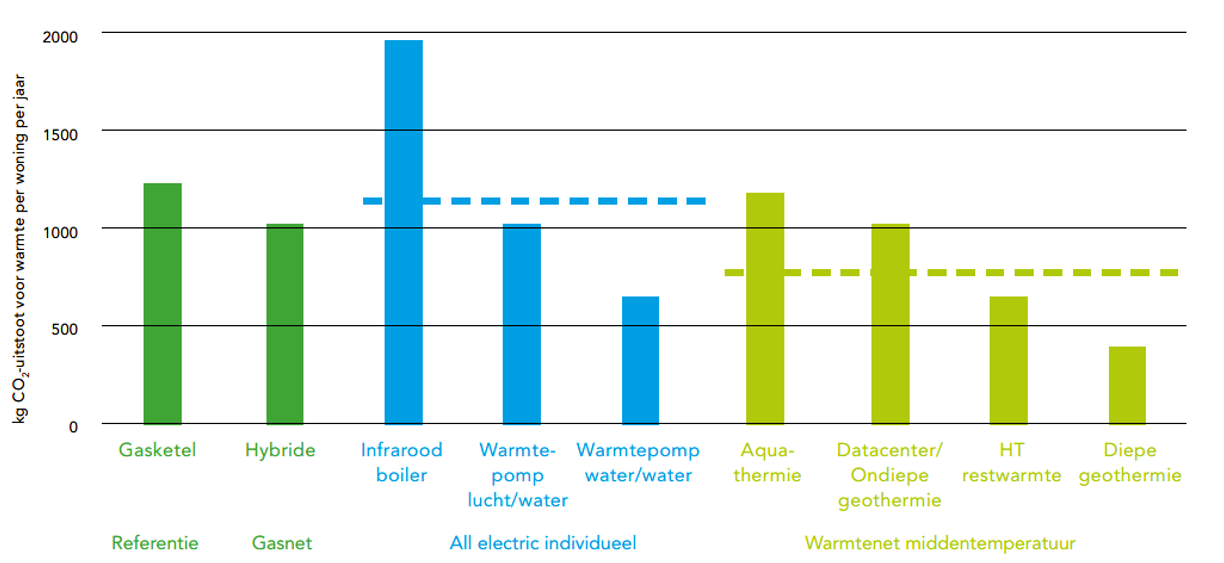

The graph from Amsterdam’s transition document below shows that heating from alternative energy sources is seen as a major opportunity. This includes renewable electricity, excess heat, aqua- or geothermal sources and green gas. Companies active in these segments can benefit from the heat transition. Hydrogen, on the other hand, is not expected to be available within the heat transition’s timeframe and the hydrogen sector is therefore not expected to be directly impacted by the heat transition.

The private sector needs to come forward with innovative and cost effective solutions, as some of the proposed heating solutions currently still emit substantial amounts of carbon dioxide.

Conclusion

The municipal Heat Transition Visions specify the phasing out of natural gas for residential uses by 2040-2050. This creates market opportunities in 3 areas:

Investments in insulation and other energy savings. These are independent on technological choices and provide immediate market potential as ‘no regret investments’.

Investments in energy infrastructure are imminent as sources of energy and energy consumption will change.

Transition to sustainable heat sources, such as geothermal energy, is a continuing trend. There is still ample room for innovative and cost effective solutions in this area.

Baker Tilly Corporate Finance has experience in the energy transition market, with services ranging from M&A to due diligence and valuation. Past clients include Zonel Energy (Solar panels), Pryme Cleantech (waste-to-energy) and Isolblow (insulation & building). Interested in finding out more about our services? Get in touch and find out how we can help you!

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.