State Secretary Vijlbrief sent a letter to the Netherlands House of Representatives on 26 June 2020 in which he indicates that the Mandatory disclosure obligations will be deferred due to COVID-19. Reportable arrangements in the period 25 June 2018 to 30 June 2020 must be reported by the intermediary or relevant taxpayer no later than 28 February 2021. For additional background information concerning the Directive, please refer to our previous news article.

Furthermore, the announced guideline on reportable cross-border arrangements was published on 30 June 2020. This guideline concerns the Dutch implementation of Mandatory disclosure and contains illustrative examples.

When does the information have to be reported?

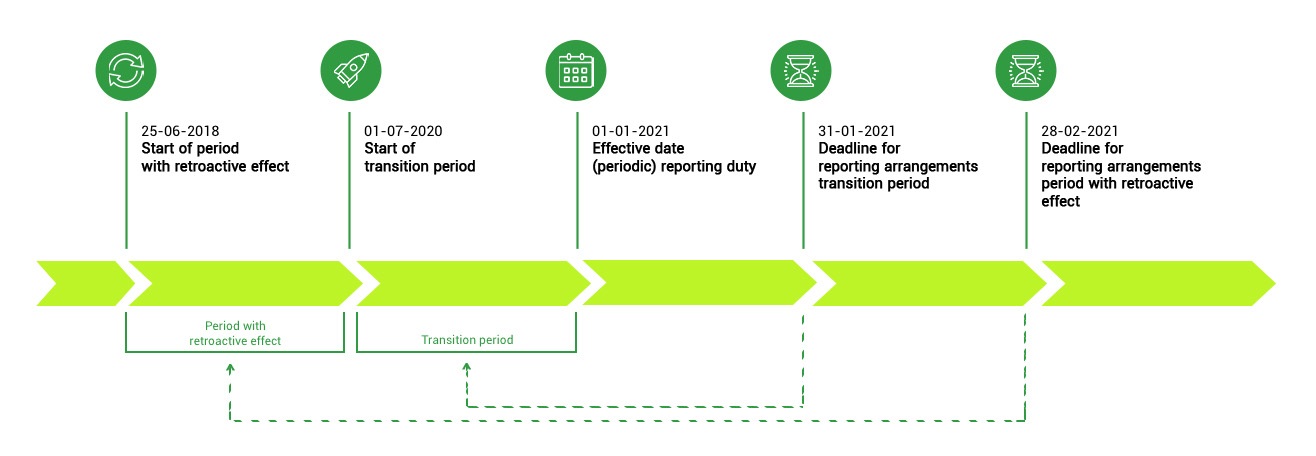

The deadline concerning the period 25 June 2018 – 30 June 2020 is not the only deferred deadline. The introduction of the reporting requirement with a deadline of one month has also been postponed. Until now, this reporting requirement would have taken effect on July 1, based on which the reports concerning the month of July would need to have been submitted no later than August 1. Reportable arrangements in the period 1 July 2020 – 31 December 2020 must be submitted no later than 31 January 2021 as a result of the deferral. The State Secretary has provided the following timeline:

Guideline reportable cross-border arrangements

The Guideline aims to provide a clarification of the legislation implementing Mandatory Disclosure. Examples are given of reportable arrangements and arrangements that do not need to be reported for each hallmark. We believe that the Guideline confirms that the Dutch implementation of the Directive particularly targets aggressive arrangements. The Guideline concludes that arrangements can be submitted to the Mandatory Disclosure Rules team of the Dutch Tax and Customs Administration in advance in an anonymous form to learn whether or not they must be reported in their opinion.

Risks

Baker Tilly has set up an internal management reporting system used to identify the risks and to meet the potential reporting duty. If we intend to submit a report, we will communicate this with the clients in question in advance. If you have any questions concerning Mandatory Disclosure, you can contact one of the members of the Baker Tilly MDD Team at [email protected].

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.

Other insights

-

Minimum taxation Pillar 2: exclusions, safe harbours, and pitfalls

-

Pillar Two: How to prepare for the new minimum taxation

-

Pillar Two: Introducing a minimum level of taxation for multinational enterprises and large companies in 2024