Your organisation is part of an international structure. Within this structure, loans are provided and interest payments take place. You wish to ascertain to what extent the interest expenses are deductible. Interest deduction is a complicated area of corporate income taxation. There are currently quite a few measures which may limit the deduction of interest. One example is the earnings stripping measure, which limits the deduction of excessive interest expenses. The Anti-Tax Avoidance Directive 2 (ATAD2) is another measure which may limit the deduction of interest with regard to financial instruments. This could occur in the case of a hybrid mismatch. But what exactly is a hybrid mismatch?

Hybrid mismatches concern differences in qualification stemming from differences in States’ tax laws. Examples are differences in the qualification for tax purposes of entities, financial instruments and permanent establishments. We will elaborate on hybrid mismatches involving financial instruments, below.

Differences in qualification regarding financial instruments

A foreign participant/shareholder of a Dutch entity (such as a BV, NV or cooperation) may provide cash funds to the Dutch entity in the form of a loan, or as capital. The qualification as a loan or as capital depends amongst other things on the legal form and the terms of the funding. The qualification also depends on the (tax) laws of the States involved. For example, the State of the lender may qualify the funding as capital, while the State of the borrower maintains the qualification as a loan. This results in a hybrid financial instrument.

Benefitting from difference in qualification

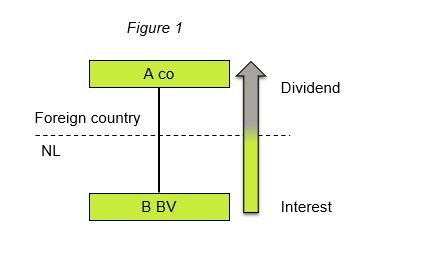

Prior to ATAD2, one could benefit from a hybrid financial instrument by making use of the differences in qualification. The benefit consisted of a deduction without inclusion in taxation, and is illustrated as follows:

In the figure above, a payment is performed by B BV to A co. The Netherlands recognises a deductible interest payment as, by Dutch standards, A co has provided a loan to B BV. From the perspective of the State in which A co is resident, the payment concerns a tax-free receipt of dividends from a contribution of capital. In this way, deduction without inclusion in taxation is attained.

ATAD2, what now?

As of 1 January 2020, ATAD2 is in force. ATAD2 addresses the tax benefits arising from hybrid mismatches. This may lead to a situation in which interest expenses, which were deductible prior to 1 January 2020, are potentially no longer deductible. Recognising hybrid mismatches of financial instruments in the structure of an organisation requires specialist expertise, as well as knowledge of foreign tax law.

Baker Tilly has the specialist advisors who can assist you in investigating your hybrid mismatches. An important additional benefit is that Baker Tilly is a part of the Baker Tilly International network. This enables us to quickly and efficiently involve foreign specialists in the ATAD2 analysis, where needed.

Every company that is part of an international structure, will have to deal with ATAD2. You can learn more about this complex fiscal legislation, and our expertise in this area, on our special ATAD2 webpage. In addition to up-to-date knowledge of ATAD2, Baker Tilly has developed a web-based tool: the ATAD2 Risk Assessment. Would you like to gain a preliminary insight into the ATAD2 risks in your specific case? Please check out our ATAD2 Risk Assessment.

Contact

Do you have any questions regarding your business and the consequences of ATAD2? Would you like to perform an impact analysis regarding ATAD2 for your organisation? Or do you have any other questions concerning international tax law? Please do not hesitate to contact us.

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.

Other insights

-

Minimum taxation Pillar 2: exclusions, safe harbours, and pitfalls

-

Pillar Two: How to prepare for the new minimum taxation

-

Pillar Two: Introducing a minimum level of taxation for multinational enterprises and large companies in 2024