Prior to 2019, losses incurred by entities whose activities consisted entirely or almost entirely of holding or financing activities, could only be offset against profits in years in which those entities also (almost) only perform holding or financing activities. This so-called ‘holding loss scheme’ was abolished as of 2019, but as a result of transitional law, such ‘holding losses’ incurred up to and including 2018 are subject to a limitation regarding offsetting against future profits. However, the Dutch Supreme Court recently ruled that, under certain circumstances, such holding losses may in fact be offset against ‘normal’ profits.

Fiscal unity with newly incorporated subsidiary entity

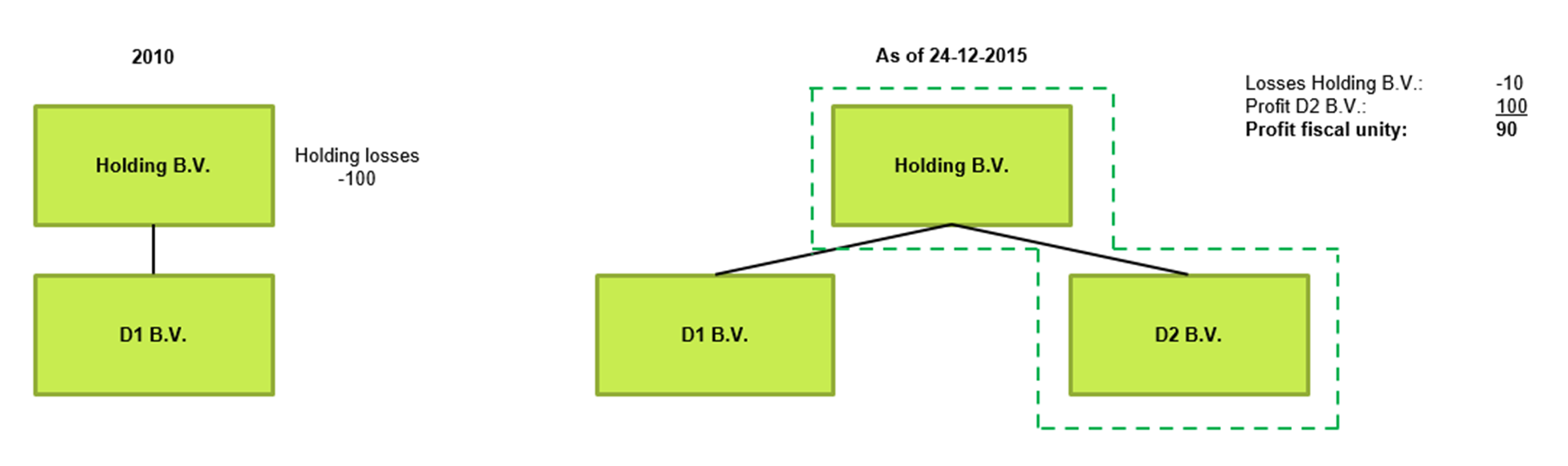

The case before the Dutch Supreme Court can be summarised as follows. The 2010 losses of Holding B.V. constitute holding losses (e.g. 100). Holding B.V. incorporated a new subsidiary entity, D2 B.V., on 24 December 2015. Holding B.V. and D2 B.V. formed a fiscal unity for corporate income tax purposes, as of the date of incorporation of D2 B.V. In 2016, Holding B.V. incurred a loss (e.g. 10) whereas D2 B.V. realised a ‘normal’ profit (e.g. 100). Overall, the fiscal unity therefore realised a profit of 90.

The question at hand was whether the profit of the fiscal unity in 2016 could be decreased by offsetting the 2010 holding losses. The Dutch Supreme Court answered this question in the affirmative, because:

notwithstanding the existence of the fiscal unity, the activities of Holding B.V. were assessed at an individual level in order to determine whether these activities consisted (almost) entirely of holding and financing activities (which was the case); and

the profits of an entity that was included in a fiscal unity upon the incorporation of that entity (D2 B.V.) is considered profit of the entity that incorporated it (Holding B.V.).

The ‘normal’ profit of D2 B.V. (i.e. 100) was therefore considered to be profit of Holding B.V. Meanwhile, Holding B.V. had not lost its status as a holding or financing entity.

Practical consequences

The Dutch Supreme Court’s judgement offers opportunities for offsetting existing holding losses. It is possible that legislation will be introduced, removing this possibility of offsetting holding losses. If you are in a situation that is similar to the example described above, and you wish to make use of this possibility, we advise you to take action swiftly.

Our tax advisors would be happy to help you, should you have any questions about the matter.

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.

Other insights

-

Minimum taxation Pillar 2: exclusions, safe harbours, and pitfalls

-

Pillar Two: How to prepare for the new minimum taxation

-

Pillar Two: Introducing a minimum level of taxation for multinational enterprises and large companies in 2024