Recently, the European Commission published a comprehensive document in which it proposes to change the Customs Union drastically. In the words of Commissioner Gentiloni, who presented the document on Wednesday 17 May 2023, it is the “most ambitious and comprehensive reform since the creation of our Customs Union in 1968”. In this article, we will provide an overview of the main elements of the proposed changes. We will also discuss the impact and possible consequences for your business if the proposal is adopted.

Reason for the proposal

The European market and Customs Union are under pressure. On the one hand, this is due to geopolitical circumstances such as Brexit and the Russian-Ukrainian war, which have imposed unforeseen trade restrictions. On the other hand, there have been noticeable shifts in global trade flows in recent years, as a result of for instance the exponential growth of the e-commerce sector. These developments have prompted the Commission to reconsider the principles of the current European Customs Union.

“ “It is time to take the Customs Union to the next level, equipping it with a stronger framework that will allow us to better protect our citizens and our single market.” – Ursula von der Leyen, July 2019 ”

The proposal rests on two objectives. First, it aims to drastically reduce the administrative burden for both entrepreneurs and governments. Second, the changes are intended to enhance the ability of customs authorities to protect the financial and non-financial interests (think environmental protection and trade security) of EU countries. In short, the Customs Union needs to be modernised.

Notable changes

The Commission proposal is no fewer than 250 pages long and contains hundreds of new or revised measures. Without giving an exhaustive overview, there are several interesting changes that stand out. We discuss these broadly below.

1. Formation of an EU Customs Authority

Currently, EU control over global trade is fragmented. This is because the customs authorities of the 27 EU Member States exercise their powers largely as they see fit, with no overarching body to safeguard the strategic interests of the EU as a whole. To combat this fragmentation, the Commission proposes the creation of an EU Customs Authority. The core task of this supranational organisation will be to bring together expertise and direct and support the agencies of the various Member States. In this way, customs control tasks can be carried out in a unified and coordinated way throughout the EU (acting as one). This benefits both the EU’s financial and non-financial interests.

2. Establishment of a EU Customs Data Hub

A second important change to combat fragmentation concerns the intention to establish an EU Customs Data Hub. At its core, this data hub is nothing more than a centralised digital system for reporting, processing and storing every conceivable piece of information relevant for customs purposes. In the future, entrepreneurs will only have to send information to the government through the EU Customs Data Hub. This means the hub will replace Member States’ current IT infrastructures, which rely on as many as 111 (!) separate modules and reporting systems. The idea is to make the process of providing information to the government more efficient and manageable.

3. Supply Chain Supervision: a new European approach to risk

The EU Customs Data Hub will not only be used for reporting and the provision of information. According to the Commission, the data hub is also intended to provide information as part of a completely revised risk approach to global trade. This approach is based not on single transactions or shipments, but on entire trade chains. With the help of verifiable supply chain information, anomalies in trade patterns can be detected more precisely and effectively. This will help tackle smuggling and fraud. In this context, the Commission wants to create a focused, dynamic, inclusive and data-driven form of risk management. The idea is that detection and compliance will benefit from a feed of up-to-date and accurate supply chain information coming from a centrally managed source (the EU Customs Data Hub).

4. ‘COSS’: the Customs One-Stop-Shop

If it is up to the Commission, entrepreneurs who meet certain reliability requirements – the so-called trusted traders – will be permitted to use the future Customs One-Stop-Shop. This means that they only have to interact with one customs authority: that of the Member State in which they are established. This COSS aims to reduce operating costs and administrative burdens, both for governments and entrepreneurs. In addition, trusted traders will be permitted to import their goods through so-called green lanes, benefiting from an accelerated completion of various customs formalities.

5. Introduction of a special customs regime for e-commerce

Significant changes were introduced for VAT in 2021 regarding the taxation of imports of e-commerce shipments from outside the EU. The Commission now also intends to adapt customs regulations to the specific characteristics and needs of this relatively modern form of cross-border trade. One of the proposed changes is that digital platforms that facilitate e-commerce sales (think Amazon) will be made responsible for all customs formalities and customs payment obligations. Customs duties will then be due at the time of acceptance of payment by the consumer, as is already the case for import VAT. Also of interest is the fact that the threshold for small consignments of €150, up to which amount a customs duty exemption applies, will be abolished. Linked to this is the intention to allow the use of the so-called Import One-Stop-Shop (IOSS) for the payment of VAT on imports for consignments with a value of €150 or more, as well. Finally, a simplified system will be introduced for calculating customs duties due on imports of small-value consignments.

Timetable for changes

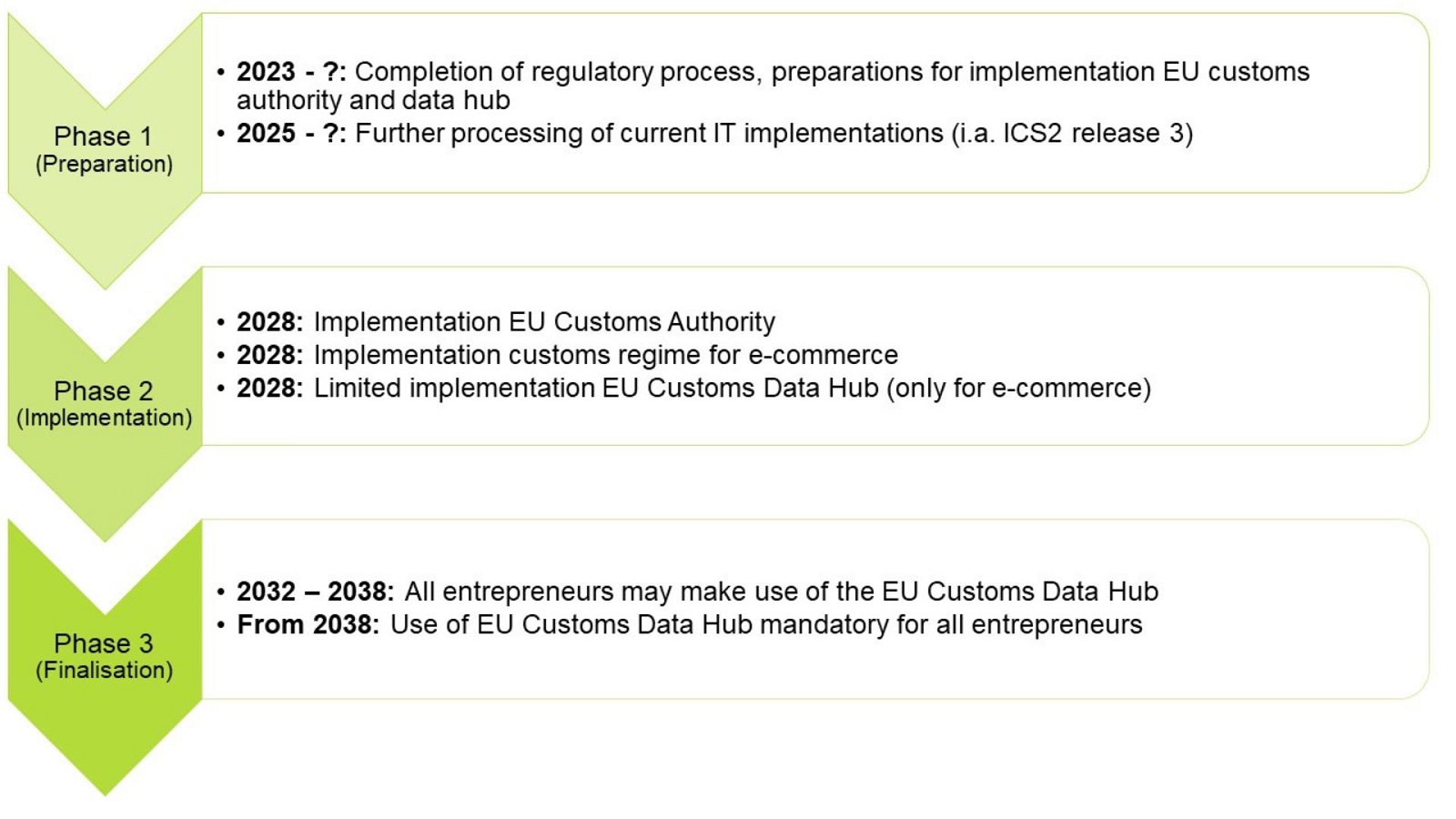

The Commission’s plans are currently still in the regulatory process. It is therefore uncertain whether, and in what form, the measures will eventually be introduced. Nonetheless, the proposal sets out a provisional agenda, which assumes a phased rollout of the changes. The figure below provides a brief overview of this.

What does the proposal mean for your business?

The European Commission’s plans are tremendous in scope and can rightly be called far-reaching. If at any point political agreement is reached on the proposed regulation, every internationally trading company is expected to be affected by the measures. For instance, the introduction of the EU Customs Data Hub will require changes to business records and customs reporting. In addition, entrepreneurs must consider whether it is advantageous to use optional regimes such as the COSS. Of course, our experts are keeping a close eye on developments and would be happy to assist you in mapping out the consequences of the proposed measures.

Would you like to know more about the proposed plans, or do you have other customs-related questions? Marisa Hut and Stevie Mols of VAT & Customs Advisory would be happy to update you on the developments, concerns and opportunities in international trade.

Laws and regulations in this area may be subject to change. We recommend you discuss the impact of this matter with your Baker Tilly advisor.

Other insights

-

‘VAT in the Digital Age’: the new ViDA rules are coming!

-

EU Deforestation Regulation (EUDR): stringent rules for importers, operators and traders

-

Customs Talks: How the new EU Deforestation Regulation (EUDR) will impact business with the UK