The State Secretary for Finance has submitted the legislative proposal regarding emergency repair measures for the fiscal unity to the Parliament. The repair measures were necessary following a judgment of the European Court of Justice of February 22nd, 2018. The bill has a retroactive effect from October 25th, 2017, 11.00 am.

This bill may be relevant to approximately 300,000 Dutch companies which make use of the fiscal unity regime. The fiscal unity regime (regarding Corporate Income Tax) involves the following. Dutch companies (the ultimate parent, direct and indirect subsidiaries) which are part of this fiscal unity are taxed as if these companies were one taxpayer (the parent company is appointed as the taxpayer). This means that assets, liabilities, equity and results of these subsidiaries are allocated to the parent company (fiscal consolidation). Transactions between companies which are part of the fiscal unity are therefore not visible for Corporation Income Tax purposes.

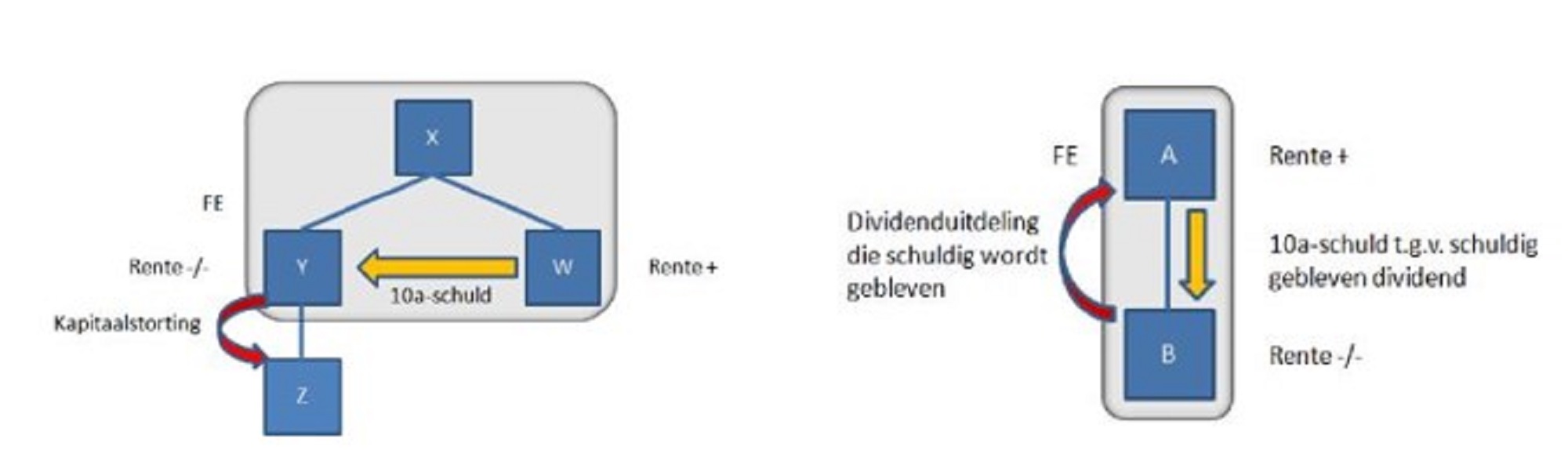

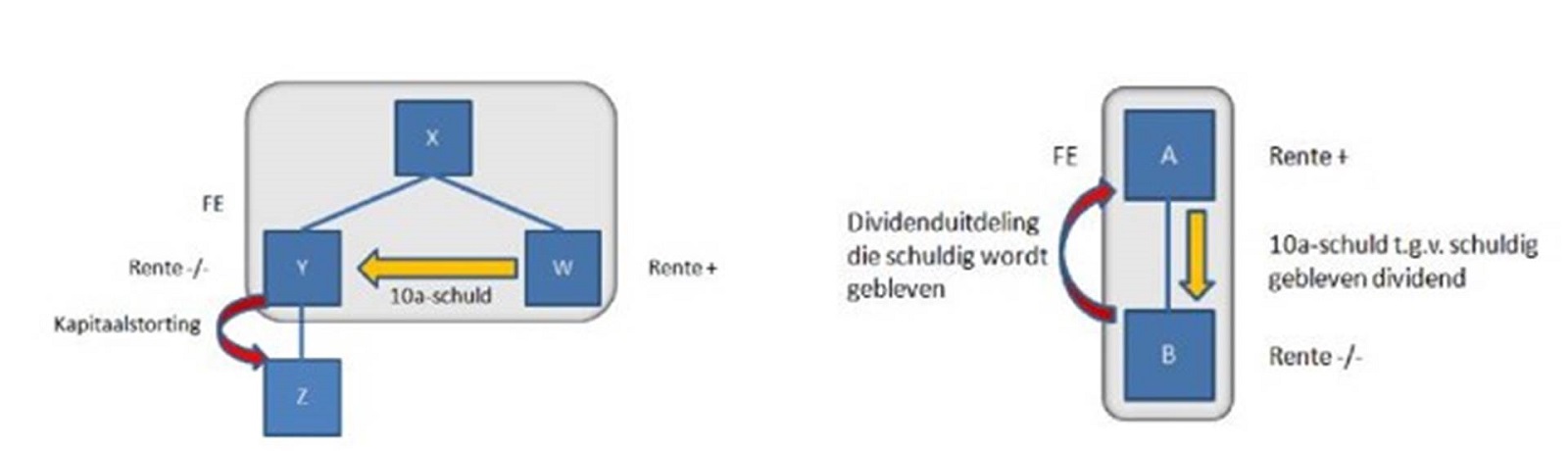

These repair measures mean that the fiscal unity is deemed not to exist for the application of certain articles in the Dutch Corporation Tax Act (‘CITA’). The most important is article 10a CITA. The other articles are mentioned below, but will not be discussed further. Article 10a, which denies the deduction of interest charges regarding loans owed to a related entity (or related private individual) if that loan is used for an ‘tainted transaction'. These loans are referred to as ‘10a-loans/debts’. Tainted transactions are dividend transactions (paid or unpaid), capital contributions (paid or unpaid) and the purchase of participations (if that participation will form a connected entity after purchase). Deduction of interest is still possible if the taxpayer can provide reasonable proof that the loan as well as the tainted transaction had real business reasons (‘the business test’) or that that the receiver of the interest effectively pays a reasonable amount of (corporate) income taxes on the interest income (‘the taxation test’).

Article 10a does not apply in both examples under current CITA, as the loan between Y and W (or between A and B) is not visible due to fiscal consolidation. The proposed bill will change this: the fiscal unity must be disregarded for the application of article 10a. This may lead to an increase of taxable profit with the amount of the denied interest deduction of article 10a CITA. If the business test or the taxation test is passed, the taxable profit will not be increased.

The bill contains allowance concession for the period of October 25th, 2017 - January 1st, 2019. This concession means that the taxable profit will not be increased with the non-deductible interest charge - under certain conditions - if the interest on 10a debts/loans is less than € 100,000 on an annual basis.

The other articles in the CITA for which the fiscal unity is disregarded from October 25th, 2017 are:

certain parts of the participation exemption (Article 13)

refusal of deduction of excessive participation interest (Article 13l)

limitation on loss settlement after the change of a shareholder (Article 20a)

Advice

The bill requires entities to investigate whether loans/ debts exist with related entities (inside or outside of the fiscal unity). Should this be the case, it must be investigated whether the loan is used for a tainted transaction (see above). Further analysis is required regarding the business test, the taxation test, and the amount of interest paid. Finally, it needs to be investigated whether there are possibilities of either repaying the 10a loan/debt or letting this 10a loan/debt disappear by means of a legal merger.

Our tax consultants would be happy to assist you in analyzing the consequences of the emergency repair for your fiscal unity (and then, if necessary, investigating measures to mitigate these consequences).

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.

Other insights

-

Minimum taxation Pillar 2: exclusions, safe harbours, and pitfalls

-

Pillar Two: How to prepare for the new minimum taxation

-

Pillar Two: Introducing a minimum level of taxation for multinational enterprises and large companies in 2024